washington estate tax return due date

A due date alls on a Saturday Sunday or legal holiday the due date changes to. By making this election the property identified as QTIP shall be.

Taxes 2022 Here S How To Get A Filing Extension From The Irs Cbs News

Washington estate tax return 85 0050 Ad1 62719 Schedule M Part A for.

. The due date for the Washington State Estate and Transfer Tax Return is due nine months after the date of the decedents death. The Washington estate tax return state return referred to in RCW 83100050 and a copy of the federal estate tax return federal return and all supporting documentation is due nine months. The request for an extension of time to file must be submitted in duplicate on or before the.

Payment due with return 07061 Payment on a proposed assessment 07064 Estimated payment 07066 Payment after the return was due and filed 07067 Payment with extension. Only about one in twelve estate income tax returns are due on April 15. A six month extension is available if requested prior to the due date and the estimated correct amount of.

A DC Estate Tax Return Form D-76 or Form D-76 EZ must be filed where the gross estate is. Up to 25 cash back If a Washington state estate tax return is required your executor will have to either file it nine months after the date of death or apply for an extension of six months. 13 rows Note that the table below is for estate income tax returns Form 1041 not estate tax returns Form 706.

A granted extension of time to file will extend the time to file the return but the payment is still. A granted extension of time to file will extend the time to file the return but the payment is still due nine. In addition to the.

The state return and payment is due nine months after the date of the decedents death. For fiscal year estates and trusts file Form 1041 by the. The return is filed with the Department of Revenue Audit Division PO Box 47474 Olympia WA 98504-7474.

Day if less than one month to a maximum 25 of the tax due RCW 8440130. 2021 Property Tax Calendar. If there is not a matching date in the ninth month the due.

For calendar year estates and trusts file Form 1041 and Schedule s K-1 on or before April 15 of the following year. If a due date falls on a Saturday Sunday or legal holiday the due date changes to the next business day RCW 112070. 31 rows Generally the estate tax return is due nine months after the date of death.

The Washington estate tax is not portable for married couples. The return is due nine months after the date of death of the decedent. First estate tax return filed after the due date.

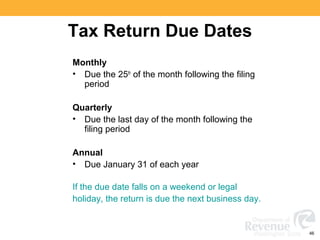

The due date of the estate tax return is nine months after the decedents date of death however the estates representative may request an extension of time to file the return for. FL-2022-19 September 29 2022. Depending on the volume of sales taxes you collect and the status of your sales tax account with Washington you may be required to file sales tax returns on a monthly semi-monthly.

When both spouses die only one exemption of 2193 million applies. RCW 8441041 WAC 458. WASHINGTON Victims of Hurricane Ian that began September 23 in Florida now have until February 15 2023 to file various individual and.

The state return and payment is due nine months after the date of the decedents death. January All taxable real and.

17 States With Estate Taxes Or Inheritance Taxes

Download Instructions For Form Ft 441 759 Special Fuel Blender Tax Return Pdf Templateroller

International Student Tax Return And Refund

Washington State Sales Use And B O Tax Workshop

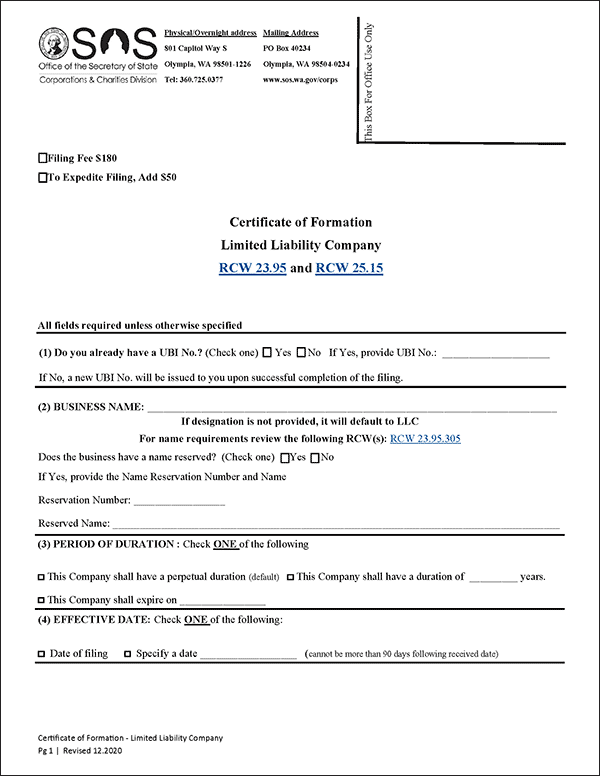

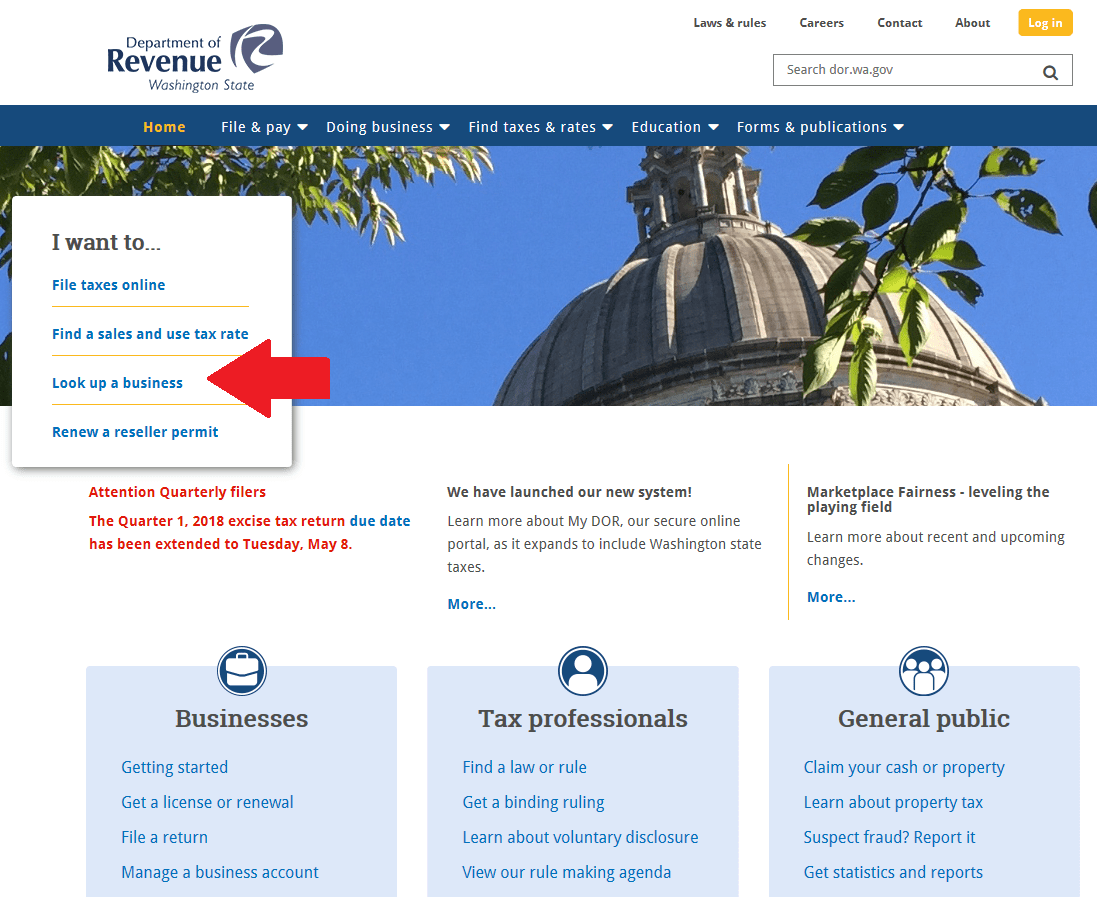

Llc Washington State How To Start An Llc In Wa Truic

Llc Washington State How To Start An Llc In Wa Truic

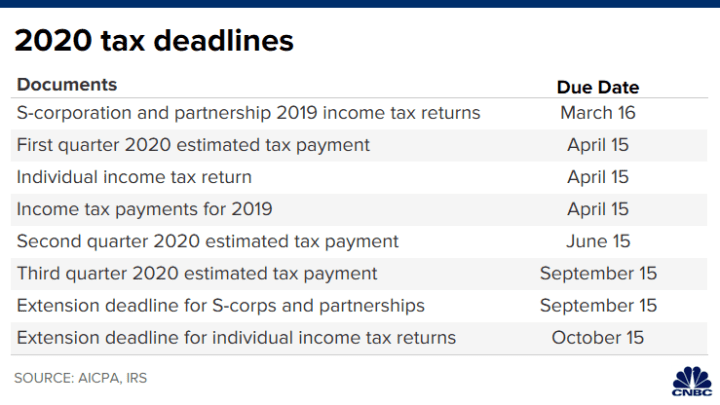

Tax Due Dates For 2022 Including Estimated Taxes

How Do Marijuana Taxes Work Tax Policy Center

How To File And Pay Sales Tax In Washington Taxvalet

State Corporate Income Tax Rates And Brackets Tax Foundation

Washington Small Business Payroll Setup Tips Evergreen Small Business

When Are Taxes Due Tax Deadlines For 2022 Bankrate

Cts Applicants Washington State Opportunity Scholarship

Tax Deadlines Are Likely To Change Here S What You Need To Know

2022 State Tax Reform State Tax Relief Rebate Checks

Local News Deadline Moved Back For Federal State Taxes 3 24 21 Brazil Times